Why CRM is the Game-Changer in Challenging Startup Investment Climate

Hello fellow entrepreneurs and startup enthusiasts!

Startups face various challenges in their journey towards success, but using CRM tools can make a significant difference, particularly in difficult investment downturn environments. Implementing CRM systems can drive revenue growth and attract investors who recognize the value of a robust recurring revenue stream.

Therefore, if you're dealing with a tough investment climate, consider integrating CRM software like HubSpot or Bloomreach into your business strategy and set yourself up for success!

Let's buckle up and explore the possibilities!

Why CRM is a must-have for startups looking to thrive in challenging investment downturn:

1. Understanding the Startups' Investment Downturn Environment

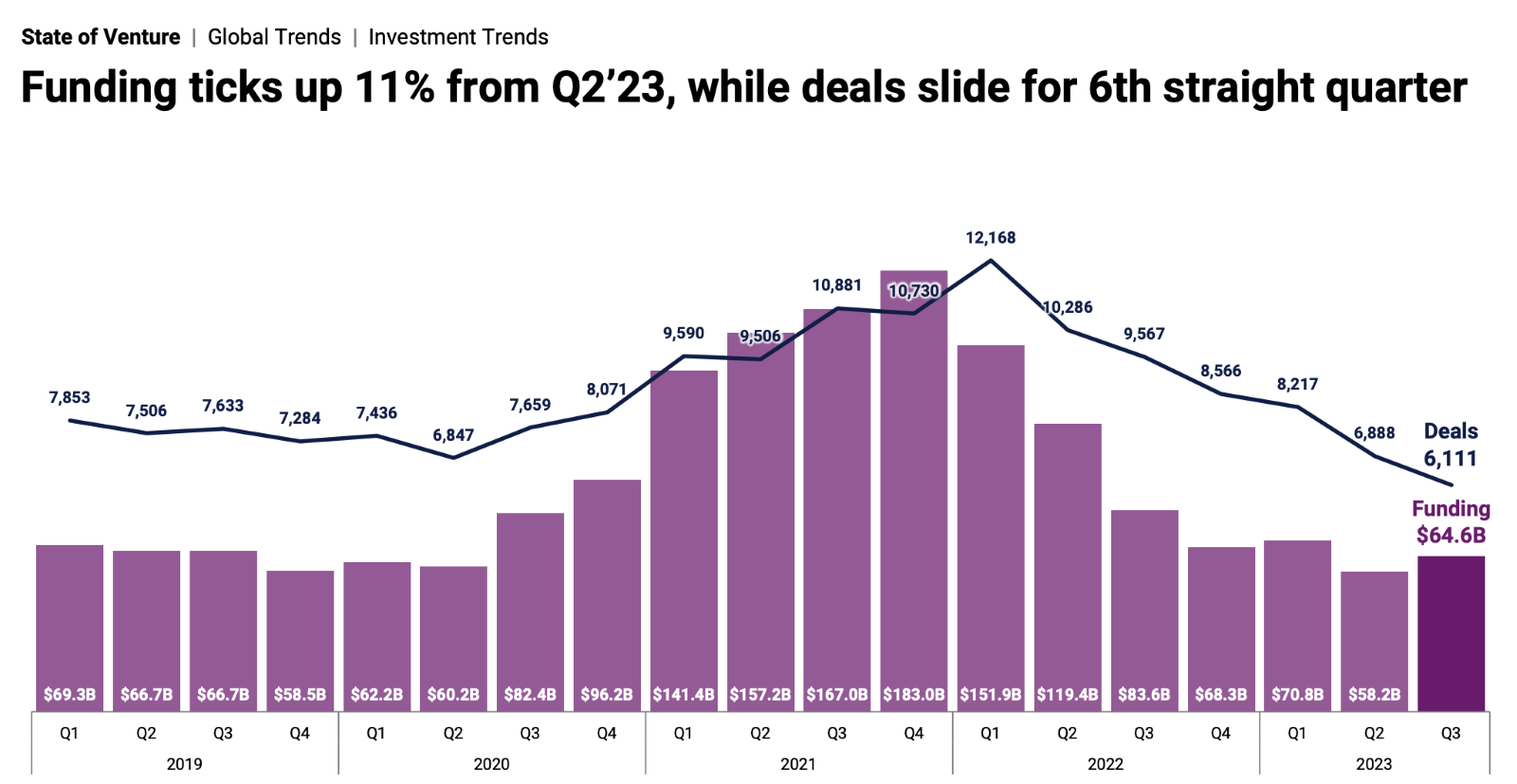

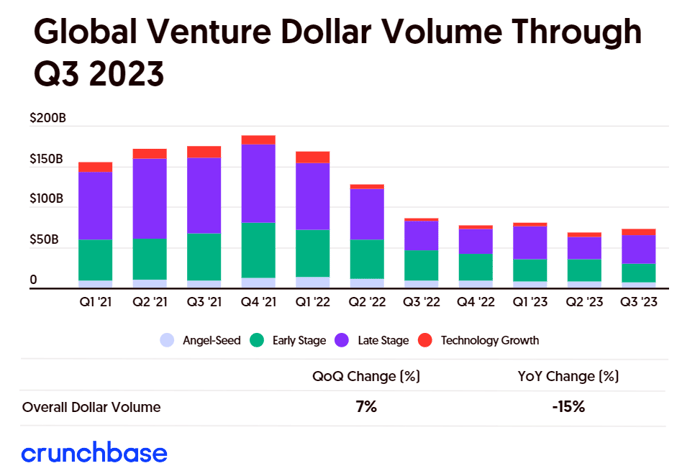

In 2023, the startup investment landscape experienced a downturn. Global VC deals decreased to 6K in Q3 2023 with $65B funding, similar to Q3 2019.

Credit: CB Insights Q3 2023 State of Venture Report

Investors became more risk-averse during the pandemic, which led to a decline in early-stage funding for startups. Some experts believe this decline is due to investors becoming more selective and seeking higher-quality startups with a proven track record.

Marshall Porter, the tech VC in New York, the AlleyCorp’s general partner, predicts that there will be thousands of companies raising funds in 2024 that bridged through 2023. Most of these companies will look the same, with low growth, default alive, or lower burn. The outliers that can secure funding much easier are those with a proven track record and a sustainable business model. It's still about execution, but startups can't grow by giving away their product — that era feels over.

The decrease in investment led venture capitalists to focus on startups that had recurring revenue models. Such startups provided a more stable and predictable investment option. This change in investment criteria was due to the need for startups to exhibit sustainable business models and the ability to generate consistent cash flow, especially in an unpredictable economic environment.

The global economic slowdown decreased overall investor confidence, leading to a more cautious approach towards funding startups. Additionally, the aftermath of the COVID-19 pandemic continued to impact the investment ecosystem, with investors becoming more risk-averse and seeking more stable investment opportunities.

Venture capitalists (VCs) significantly changed their investment criteria, placing higher importance on recurring revenue. This shift was driven by the need for startups to demonstrate sustainable business models and the ability to generate consistent cash flow. VCs became more focused on startups that had proven their ability to retain customers and generate recurring revenue streams.

The emphasis on recurring revenue was driven by several factors. Firstly, it provided a more predictable and stable source of income, reducing the risk associated with startups heavily reliant on one-time sales or sporadic revenue streams. Secondly, recurring revenue models often indicated a higher level of customer loyalty and engagement, which increased the long-term growth potential of the startup.

As a result, VCs started looking for startups with subscription-based business models, software-as-a-service (SaaS) companies, and other businesses that had established recurring revenue streams. Startups that could demonstrate a strong customer base, high customer retention rates, and a predictable revenue growth trajectory became more attractive to investors.

This shift in investment criteria also led to changes in the due diligence process. VCs started scrutinizing startups' financial metrics, such as monthly recurring revenue (MRR), annual recurring revenue (ARR), customer acquisition costs (CAC), and customer lifetime value (CLTV). These metrics became key indicators of a startup's ability to generate sustainable revenue and achieve profitability in the long run.

Startups often struggle to secure consistent funding, and even more so during a downturn in investment. In such circumstances, where VCs change their due diligence criteria, it becomes crucial for startups to focus on measurable recurring revenue growth and maintaining a strong customer base.

This is where CRM comes into play.

2. Improving Customer Relationships

CRM systems are designed to streamline and optimize interactions with customers.

By collecting and organizing valuable customer data, startups can gain deeper insights into their target audience's preferences, behavior, and needs. Armed with this information, businesses can tailor their products and services accordingly, enhancing customer satisfaction and loyalty. Happy customers are more likely to continue their subscription or repurchase, ultimately boosting recurring revenue.

3. Enhancing Sales and Marketing Strategies

CRM tools provide startups with a centralized platform to manage sales and marketing activities. They enable teams to track leads, automate follow-ups, and analyze sales pipelines, empowering startups to close deals more efficiently. This not only accelerates revenue growth but also optimizes resource allocation, as sales and marketing efforts become more targeted and effective.

4. Leveraging Data-Driven Insights

In today's data-centric world, making informed decisions is crucial for startups. CRM systems offer startups the ability to collect, analyze, and interpret vast amounts of customer data. By uncovering patterns and trends, startups can identify the most profitable customer segments, optimize pricing strategies, and even predict customer churn. Armed with these insights, startups can focus their efforts on the most promising opportunities, leading to improved recurring revenue.

5. Improving Customer Support and Retention

Great customer support is the backbone of any successful business. CRM systems provide a platform to effectively manage customer inquiries, track support tickets and ensure timely resolutions. By addressing customer issues promptly and providing personalized support, startups can foster strong customer relationships and boost retention rates. Satisfied, loyal customers are more likely to stick around and continue generating recurring revenue.

Startup stories implemented HubSpot or Bloomreach ended up securing successful rund-raising:

The following case studies demonstrate how implementing CRM systems such as HubSpot and Bloomreach can help startups improve their recurring revenue, even in challenging investment downturn environments. By utilizing CRM, startups can enhance their customer relationships, optimize their sales and marketing efforts, leverage data-driven insights, and improve customer support and retention.

Case Study 1: Singapore SaaS Startup and HubSpot

Startup A, a rising star in the SaaS industry, faced difficulties managing their customer relationships and driving recurring revenue growth. They implemented HubSpot's CRM system to streamline their sales and marketing efforts. By leveraging HubSpot's all-in-one platform, Startup A could centralize its customer data, automate lead nurturing, and track sales performance. This resulted in improved customer engagement, increased conversion rates, and ultimately, successful fund-raising as investors recognized the potential of their optimized recurring revenue progress.

Case Study 2: NY based e-commerce Startup and Bloomreach

Startup B, a NY-based e-commerce startup, was struggling to optimize its online presence and drive recurring revenue growth. They turned to Bloomreach, a leading CRM and digital experience platform, to enhance customer experience and boost conversions. By leveraging Bloomreach's advanced personalization capabilities, Startup B could deliver tailored product recommendations, optimize its website's search functionality, and provide a seamless shopping experience. These improvements increased customer satisfaction, higher conversion rates, and successful fund-raising as investors saw the value in their improved recurring revenue progress.

Case Study 3: Helsinki Startup C and HubSpot

Startup C, a Helsinki subscription-based startup, was facing challenges in managing its growing customer base and retaining customers. They implemented HubSpot's CRM system to improve their customer relationships and enhance their retention strategies. By leveraging HubSpot's automation features, Startup C was able to personalize its communication, provide proactive customer support, and implement targeted marketing campaigns. These efforts improved customer satisfaction, reduced churn rates, and led to successful fundraising as investors recognized the value of their strong recurring revenue stream.

Conclusion:

Every startup has its own unique story, and success is determined by various factors.

Despite facing several challenges in a difficult investment environment, startups can significantly benefit from implementing a CRM system. By enhancing customer relationships, improving sales and marketing efforts, leveraging data-driven insights, and providing better customer support, startups can gain a competitive edge and maximize recurring revenue.

The success of some startups has shown the potential of CRM, particularly HubSpot and Bloomreach, in transforming startups and achieving successful fundraising, even in tough times.

So why not take a leap and unlock the power of CRM for your startup's recurring revenue growth?

The opportunities are limitless!

Share this

You May Also Like

These Related Stories

Chatbot Marketing and Our Offerings

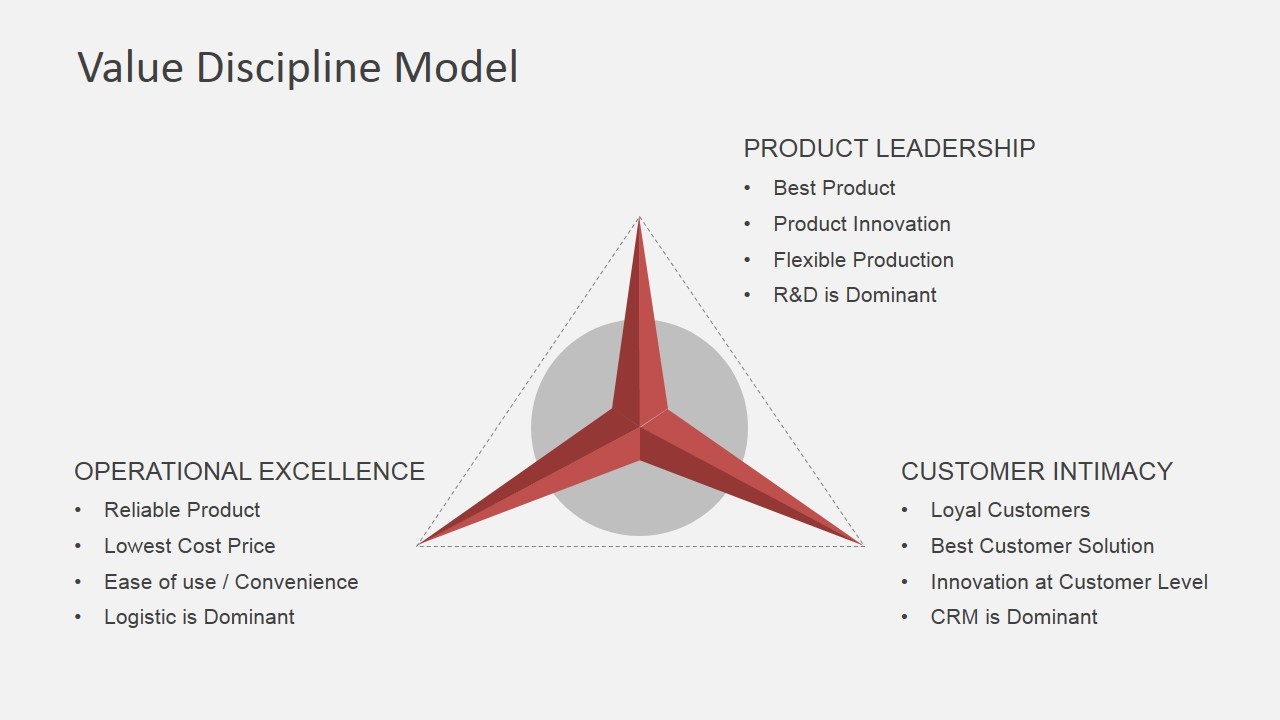

Excel in Customer Intimacy by leveraging Chatbots

.jpeg)

No Comments Yet

Let us know what you think